case study

ekyc - ANZ everify

Context

During Covid-19 lockdowns and branch closures, customers struggled to complete Know Your Customer (KYC) requirements, a mandatory step for home loans and account openings.

The in-person-only process created delays and stress at a time when the housing market remained strong. ANZ needed a secure, trusted way for customers to complete KYC remotely.

approach

Storyboarding — Illustrated potential customer journeys and highlighted opportunities for remote KYC.

Workflow design — Developed end-to-end flows with OCRLabs, ensuring compliance and security standards were met.

Customer testing — Ran multiple rounds of remote testing and refined journeys based on feedback.

Vendor collaboration — Adjusted “out-of-the-box” vendor features to simplify confusing steps without introducing risk.

UI uplift — Incorporated ANZ’s design system to ensure eVerify looked and felt like a trusted ANZ product.

my role

I was responsible for designing and mapping the customer workflows to bring eVerify to life:

Created storyboard journeys to demonstrate remote KYC possibilities.

Partnered with business stakeholders and OCRLabs, an Australian government-approved vendor.

Conducted multiple rounds of remote testing and iterated based on customer feedback.

Reworked vendor-provided flows to improve usability while maintaining compliance.

Applied ANZ’s design system to uplift the UI and establish trust in the product.

outcome

Delivered a secure and compliant solution for remote KYC.

Enabled customers to complete home loan and account opening processes without needing to visit a branch.

Integrated design improvements into OCRLabs’ standard product flows, benefiting their wider customer base.

impact

Laid the foundation for ANZ to modernise KYC beyond home loans, enabling processes to be triggered by Contact Centres or Branches at the customers convenience. This reduced onboarding friction, allowed customers to transact without delays, and ensured ANZ could continue growing lending and account services even during periods of disruption.

By mapping customer and banker journeys, I uncovered how ANZ eVerify could create wins for small business owners when used remotely, while also revealing broader opportunities across customer segments and ANZ.

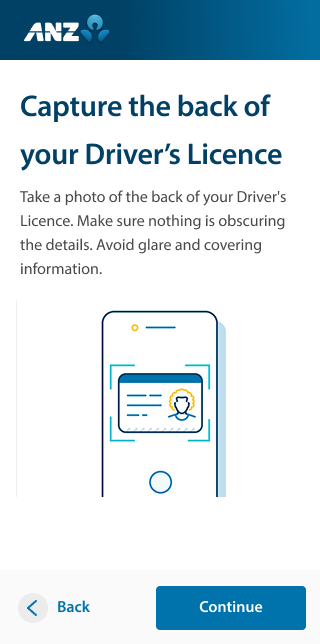

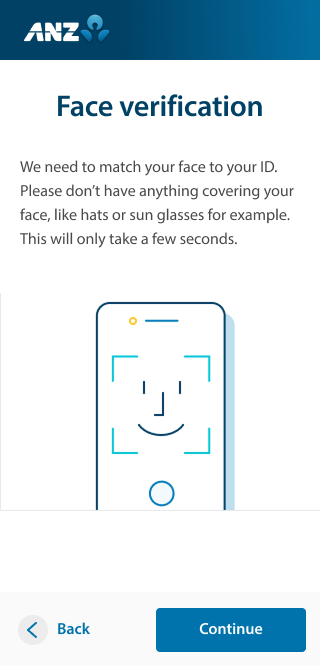

ANZ eVerify screens are simple and easy to follow. Here is a sample of the process.

Establishing design principles enabled the large project team to make decisions more effectively and with greater alignment.

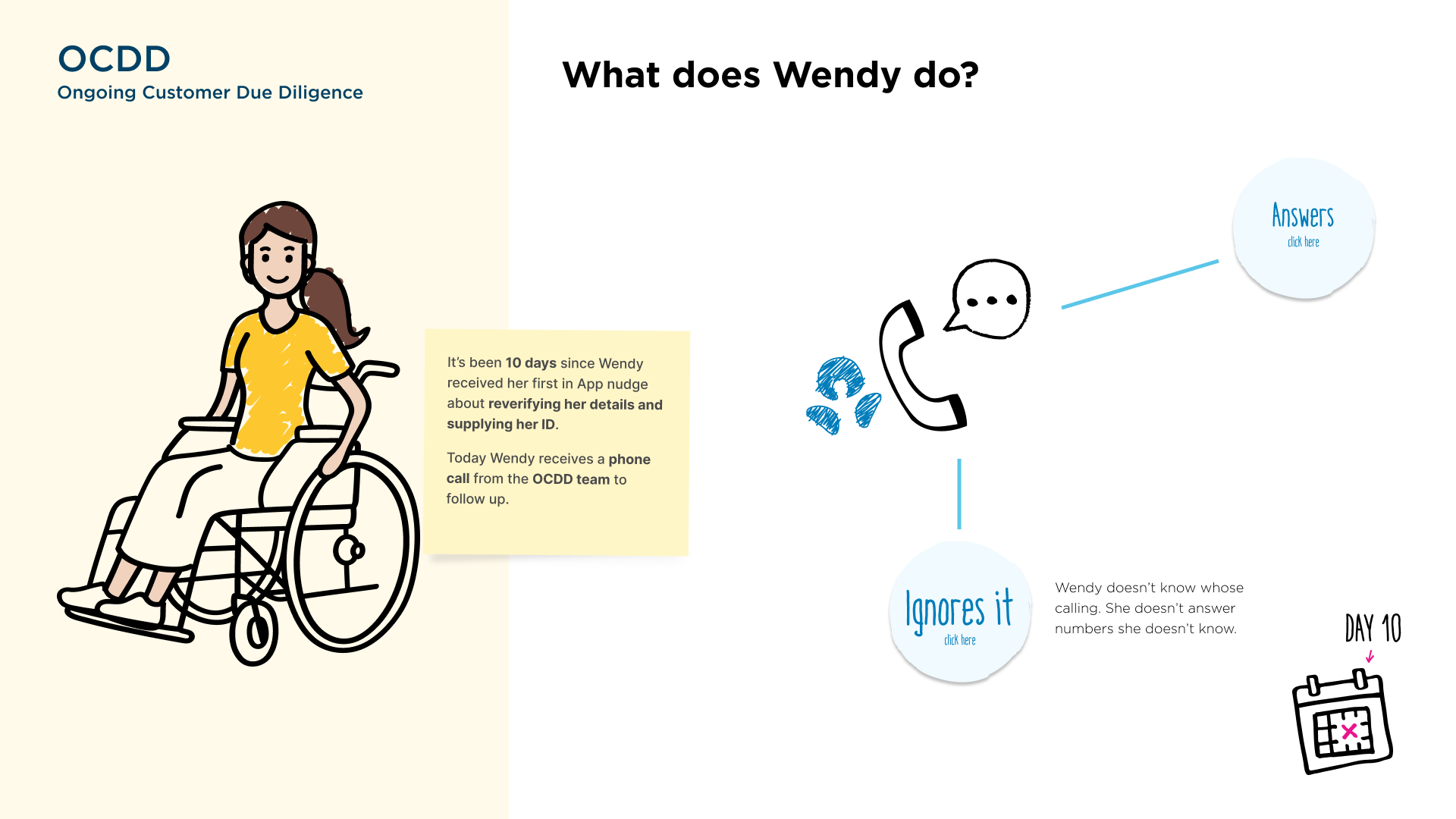

ANZ eVerify was identified as a solution for completing Ongoing Customer Due Diligence remotely, when over three million customers required KYC reverification. A ‘choose-your-own-adventure’ pack was created to help stakeholders understand communication challenges and potential adverse impacts on the activity.